Our Five Year Financial Plan

This financial plan ensures the ongoing funding of our critical and essential services whilst building on the strategy and programs established in previous plans, to transform our business and support the recovery and rebalancing of industry to a new operating environment.

In the wake of growth shown toward the back end of 2020-21, operating conditions during 2021-22 continued to be impacted by the effects of the COVID-19 pandemic. Both the Delta and Omicron variants interrupted industry’s recovery in succession and whilst the recent easing of travel restrictions provided a welcome boost to traffic and revenues, overall, our financial performance has continued to suffer, with revenues operating well below sustainable levels.

We continue to see positive steps along the path to recovery. However, volatility is forecast to continue over the next 2 years as our customers restore service capacity. Our plan assumes that domestic traffic will rebalance during 2022-23, and restrictions on international travel will continue to ease with the market recovering by 2024-25.

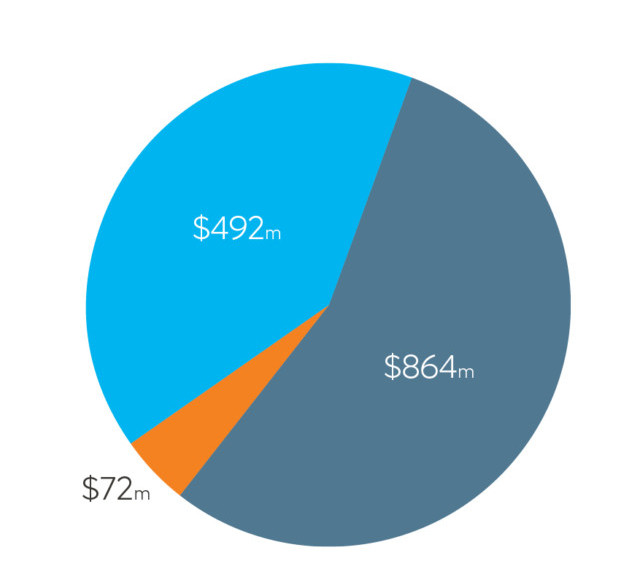

We continue to prioritise our investment in key strategic programs and will fund $1.4 billion over the 5 years in delivering our transformation ambition. The 5-year operating projections and performance measures are shown in Table 2.

Our Pricing

We set our prices in consultation with our customers for core airways services under Long Term Pricing Agreements. Under the provisions of the Competition and Consumer Act 2010 any increase in prices must be communicated to the Australian Competition and Consumer Commission for review.

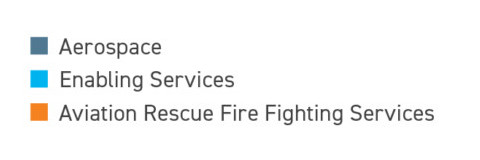

We last increased our prices on 1 July 2015 and have therefore delivered a 17% price reduction in real terms as at 2021-22. The plan assumes price increases in line with inflation from 2023-24 onwards, as we see successful industry recovery and align our cost base and services to match the new industry demand. We will deliver a further 4% real price reduction to customers through to 2026-27 for our current services, reflecting a realignment of our underlying cost base to match a 15% reduction in traffic assumptions compared to our pre COVID-19 plan.

Real Airways Price Change 2015 – 2027

Our Financial Operating Performance

With industry still recovering, we will continue to transform our services and cost structures to ensure we foster and enable the growth of the aviation industry. This means lower levels of financial performance over the next 5 years.

The ongoing delivery of cost savings and key transformations in the way we deliver our services leveraging increased automation and digitalisation, will improve the efficiency of our cost base and our long-term financial sustainability. However inflationary pressures are projected to impact wages and supply chains over the planning horizon and adversely impact previously planned profits.

The continued financial support from the Government has been vital in easing funding shortfalls through the recovery and helping strengthen our balance sheet. This has allowed us to continue to deliver safe, regular and efficient services, and allowed us to continue to invest in our transformation.

The plan proposes to start paying dividends from 2026-27 as we start making reasonable returns.

TABLE 2: Operating Projections and Performance Measures

| ($ million) | FY2022 FORECAST | FY2023 PLAN | FY2024 PLAN | FY2025 PLAN | FY2026 PLAN | FY2027 PLAN |

|---|---|---|---|---|---|---|

| Revenues | 540.1 | 924.7 | 1,075.8 | 1,140.1 | 1,200.2 | 1,298.2 |

| Staff Costs | 726.0 | 690.6 | 663.0 | 642.7 | 671.7 | 699.3 |

| Supplier Costs | 225.6 | 290.1 | 322.4 | 336.7 | 327.2 | 315.5 |

| Depreciation | 122.8 | 125.1 | 130.7 | 141.6 | 146.0 | 164.2 |

| Total Expenses Before Interest & Tax | 1,074.4 | 1,105.8 | 1,116.0 | 1,120.9 | 1,144.9 | 1,179.0 |

| Earnings Before Interest & Tax (EBIT) | (534.3) | (181.1) | (40.2) | 19.2 | 55.3 | 119.2 |

| Net Profit After Tax (NPAT) | (376.5) | (147.9) | (53.1) | (19.8) | 0.3 | 40.5 |

| FY2022 FORECAST | FY2023 PLAN | FY2024 PLAN | FY2025 PLAN | FY2026 PLAN | FY2027 PLAN |

|

|---|---|---|---|---|---|---|

| Gearing | 64% | 51% | 58% | 60% | 62% | 61% |

| Return on Assets | (26%) | (9%) | (2%) | 1% | 2% | 5% |

| Return on Equity After Tax | (56%) | (22%) | (7%) | (3%) | 0% | 5% |

| Dividends ($ million) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 12.2 |

Our Investment

To deliver our strategy and improve customer services into the future, this plan funds the delivery of $1.4 billion in investment over the next 5 years. This is driven by our continuing investment in OneSKY, the delivery of new aerodrome services at Western Sydney, Perth and Melbourne, and enabling work to modernise our network communications infrastructure and support new technologies and the ongoing transformation of our business for our customers.