Our 5-year financial plan

This financial plan ensures the ongoing funding of our critical and essential services while also building on the strategy and programs established in previous plans, to transform our business and match services to customer needs into the future.

Domestic revenues have now rebalanced at pre-pandemic levels and we now expect international revenues to reach pre-pandemic levels during financial year 2024–25 and continue to improve our level of profitability.

The economic outlook suggests inflationary and supply-chain pressures are showing some signs of improvement but with overall economic growth continuing to remain below historic levels.

We are prioritising the safety and reliability of our current services while investing in key strategic programs and will fund $1.7b over the 5 years in delivering our transformation ambition. The 5-year operating projections and performance measures are shown in Table 2.

Our pricing

We set our prices for core airways services in consultation with our customers under long-term pricing agreements. Under the provisions of the Competition and Consumer Act 2010 any increase in prices must be communicated to the Australian Competition and Consumer Commission for review.

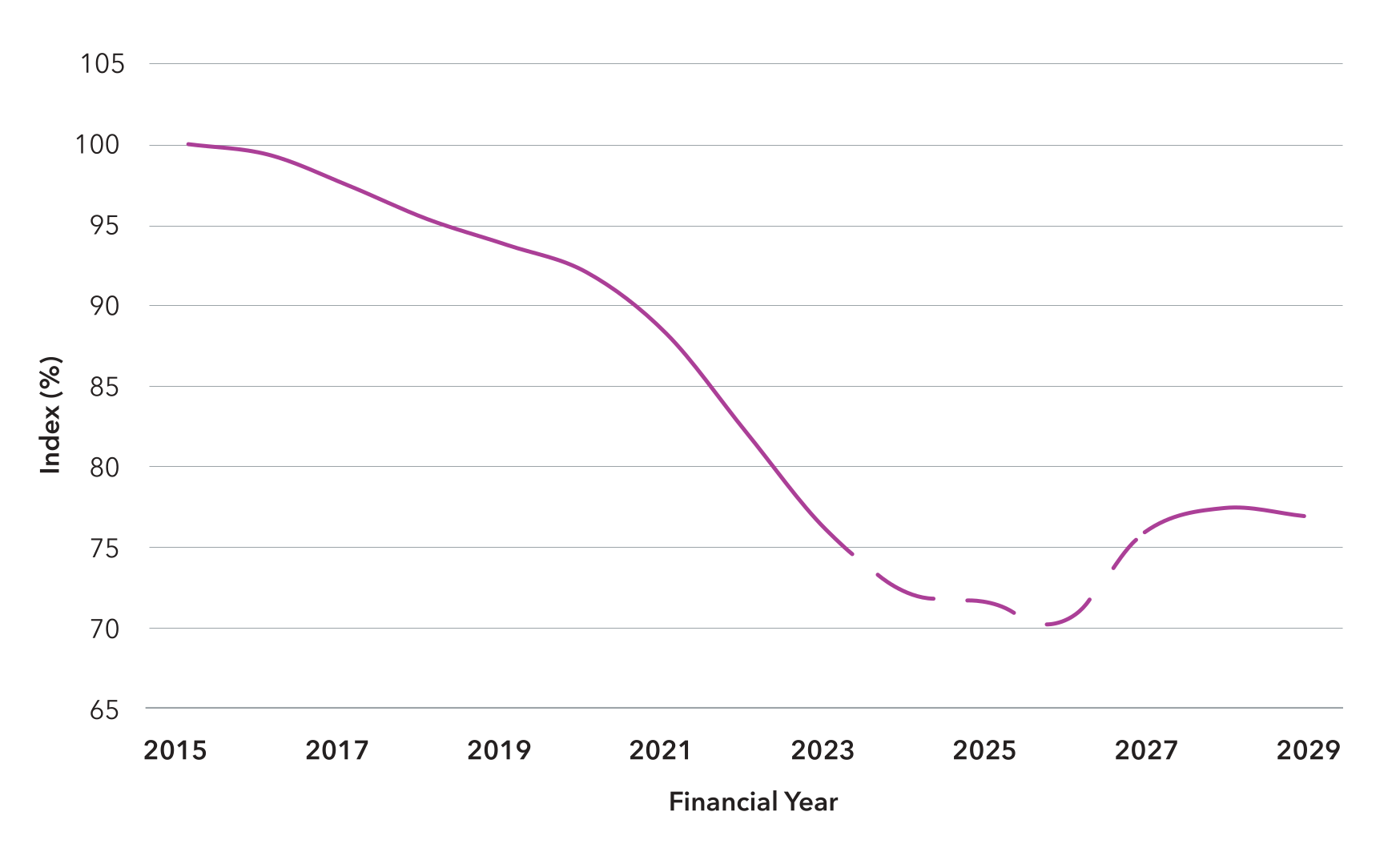

We last increased our prices on 1 July 2015 and have therefore delivered a 24% price reduction in real terms as at end of 2023-24.

From 2024–25 we are proposing modest pricing increases to fund the significant investment required to deliver a once-in-a- generation infrastructure change program to support the network’s ongoing recovery and future growth, alongside enhancements in front-line service delivery. We anticipate these increases to be manageable, affordable and realistic for industry with limited impact on industry costs.

We are prioritising the safety and reliability of our services while investing in key strategic programs and will fund $1.7B over the next 5 years

Real airways price change 2015-2029

2024-25 Corporate Plan

Our financial operating performance

We continue to support the aviation industry with valued services and foster its growth into the future. Although industry continues its recovery with lower revenue losses forecast in the near term, the costs to deliver our services and transform our business will outweigh the forecast revenues, meaning that operating losses will continue for the next 2 years. We use debt to finance our investments. Given the size of our investments to meet the growth in airport infrastructure and replenish end of life assets, there is some misalignment between our expenditure and our current revenue base. We are reviewing alternate approaches to our capital structure to better underpin financial sustainability into the future.

From 2026–27, profits are planned to return, with the transition and delivery of investment enabling benefits and growth in traffic.

Importantly, as our financial performance improves our transformation will also ensure our long-term financial sustainability, while positioning us to manage the inflation and supply-chain cost-pressures forecast over the planning horizon.

The plan proposes to recommence paying dividends in line with our minister’s expectations.

Table 2: Operating projections and performance measures − financial years ending 30 June

| ($m) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|---|

| Forecast | Plan | Plan | Plan | Plan | Plan | |

| Revenues | 1,036.5 | 1,179.4 | 1,332.2 | 1,514.5 | 1,638.6 | 1,721.5 |

| Staff costs | 762.1 | 809.0 | 843.1 | 878.0 | 908.1 | 937.0 |

| Supplier costs | 360.1 | 259.1 | 279.3 | 289.8 | 299.7 | 304.6 |

| Depreciation | 111.6 | 126.6 | 141.0 | 154.2 | 170.4 | 175.6 |

| Total expenses before interest and tax | 1,233.9 | 1,194.7 | 1,263.4 | 1,322.1 | 1,378.2 | 1,417.2 |

| Earnings before interest and tax (EBIT) | (197.4) | (15.3) | 68.7 | 192.3 | 260.4 | 304.2 |

| Net profit/(loss) after tax (NPAT) | (161.2) | (55.3) | (18.6) | 55.1 | 96.7 | 131.1 |

| Gearing | 66% | 74% | 78% | 78% | 76% | 74% |

| Return on assets | (8%) | 1% | 4% | 7% | 9% | 10% |

| Return on equity after tax | (23%) | (9%) | (3%) | 10% | 15% | 19% |

| Dividends | 0.0 | 0.0 | 0.0 | 0.0 | 45.5 | 68.3 |

Our investment

To deliver our service provision for our customers, communities, environment and travelling public, this plan funds the delivery of $1.7b in investment over the next 5 years. This is driven by our key activities as detailed in Section 3.

$1,081m

Aerospace Services

$338m

Aviation Rescue Fire Fighting Services

$305m

Enabling Services